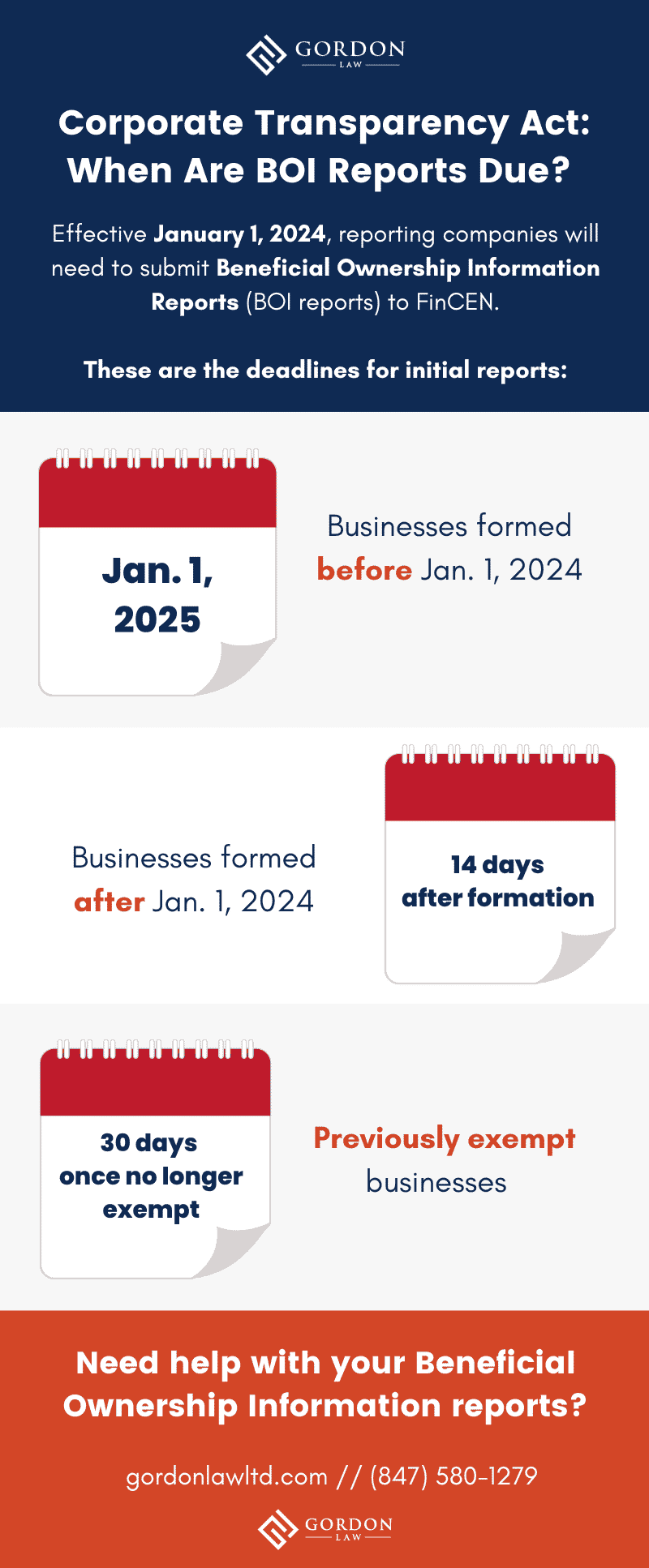

Corporate Transparency Act For 2025. The corporate transparency act, which goes into effect in january 2025, may require your small business to report information about ownership to the government. The 23 exemptions from the corporate transparency act’s bene.

Corporate Transparency Act What You Need to File and When, Effective january 1, 2025, every existing, amended or new corporation, limited liability company or other entity created by filing registration. District court for the district of alabama declared the corporate transparency act (cta) unconstitutional, a pivotal moment in the ongoing.

Corporate Transparency Act Will Begin In 2025 Sabra Melisa, How will a foreign company. Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s (cta) beneficial.

Corporate Transparency Act (CTA) Effective January 1, 2025 YouTube, The act will introduce unprecedented requirements on companies, including limited liability partnerships and other kinds of corporate entities registered at. “the corporate transparency act, through its beneficial ownership reporting requirements, provides the historic opportunity to unmask shell companies and.

Corporate Transparency Act Companies to report ownership information, The 23 exemptions from the corporate transparency act’s bene. Tax attorney alan granwell and corporate attorney peter baumgaertner will be speaking on the the corporate transparency act:

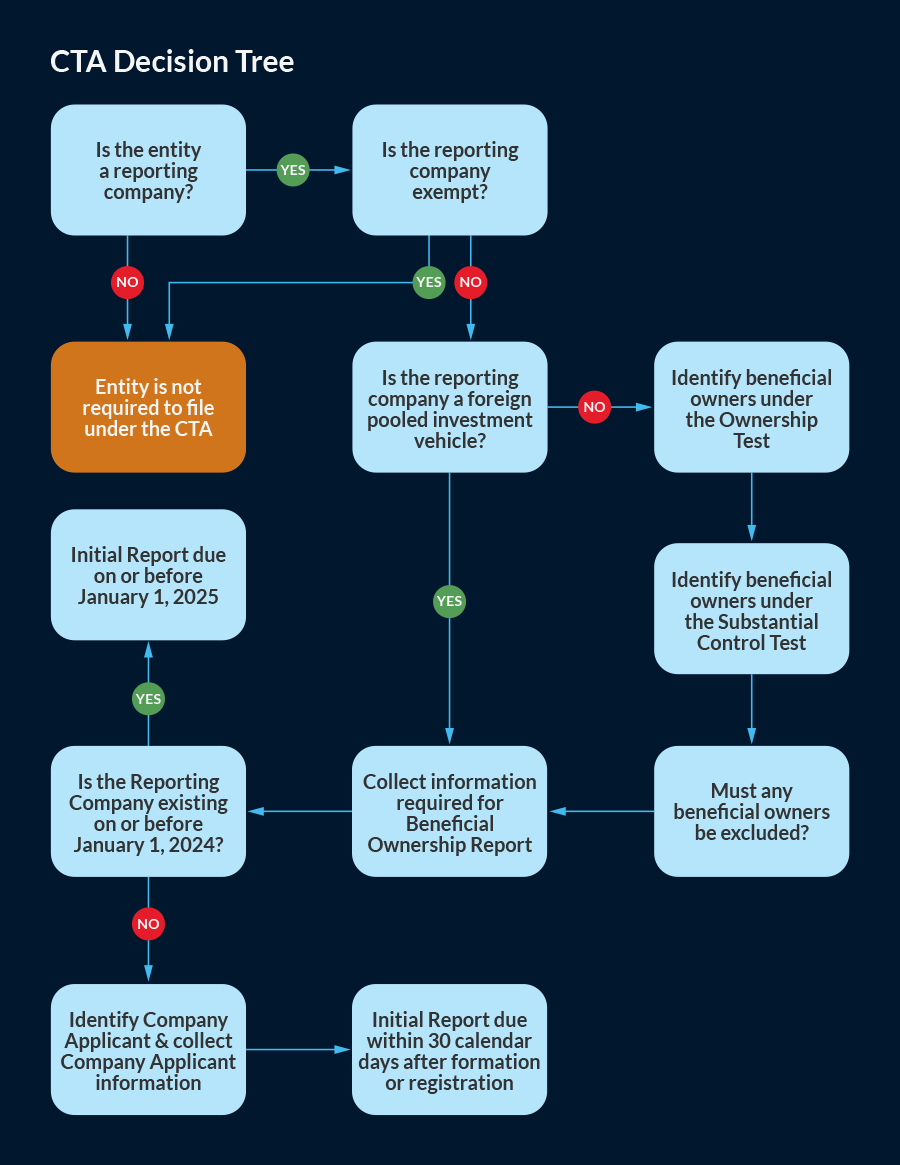

Corporate Transparency Act What Every Business Needs to Know Prior to, The corporate transparency act (the “cta”), which went into effect january 1, 2025, requires “reporting companies” in the united states to disclose. “the corporate transparency act, through its beneficial ownership reporting requirements, provides the historic opportunity to unmask shell companies and.

Corporate Transparency Act 2025 Requirements for Small Businesses, 1, 2025, a new federal reporting requirement was set in motion, requiring. The start dates for cta requirements vary based on the date of entity formation.

Corporate Transparency Act Notification and Facts Gentry Locke Attorneys, Thomson reuters tax & accounting. “the corporate transparency act, through its beneficial ownership reporting requirements, provides the historic opportunity to unmask shell companies and.

The Corporate Transparency Act and Beneficial Ownership Reporting, The 23 exemptions from the corporate. “the corporate transparency act, through its beneficial ownership reporting requirements, provides the historic opportunity to unmask shell companies and.

Corporate Transparency Act 2025 Guide For File Corporate Transparency, Thomson reuters tax & accounting. Tax attorney alan granwell and corporate attorney peter baumgaertner will be speaking on the the corporate transparency act:

What is the Corporate Transparency Act? Docubee, Let us examine the content, scope, and possible. 1, 2025, a new federal reporting requirement was set in motion, requiring.

Today, the financial crimes enforcement network (fincen) issued a final rule implementing the bipartisan corporate transparency act’s (cta) beneficial.

The corporate transparency act (“cta”), effective january 1, 2025, requires certain businesses to report certain information to the financial crimes.